Article shared by Quantum Mutual Fund

Find how ELSS (Equity Linked Savings Scheme) compares to other traditional tax-saving investments and what mistakes to avoid when investing in these funds.

1. Making Lumpsum investments at the last minute: Many investors delay their tax-saving investments until the end of the financial year. Thus, they end up making lump sum investments to meet the tax exemption limit of Rs.1.5 lakh u/s 80C. Unlike fixed income instruments such as PPF or tax saver FD, Life insurance policies, making lumpsum investments in ELSS (for instance, when markets are rising) can impact your returns.

Investors must remember that an ELSS is an Equity-linked Savings scheme and a minimum of 80% of its underlying investments comprise Equity or Equity related investments. Thus, like any equity mutual fund, it is best to avoid making a lumpsum investment especially when markets are rising. A better approach would be to reduce risk by making investments much ahead of the financial calendar year, or another option can be to opt for a staggered investment approach with a SIP (Systematic Investment Plan).

Investing through a SIP ensures that your investments in tax-saving ELSS are done in a disciplined manner and thus negates the worry about timing your entry or exit into equity markets. Investing through SIP will also allow investors the benefit of the power of compounding. Suppose an investor is investing using a SIP of Rs.12, 500 per month at the start of the financial year, he stands to gain from the power of compounding assumed at 10% CAGR (Rs.1,58,379) instead of investing lumpsum of Rs.1,50,000 at the end of the financial year, thereby allowing no room for investments to grow.

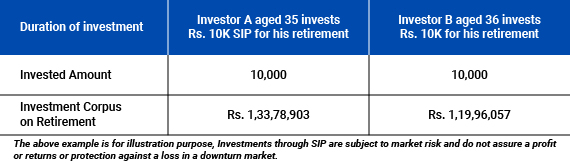

2. Delaying your ELSS SIP investments: Avoid postponing or delaying your SIP investments. ELSS investment is the only mutual fund category in the 80C investments. So, delaying or postponing your SIP investments can be detrimental to your wealth creation journey.

Growth of investment with SIP of Rs.10,000 invested @ 10% p.a. in comparison with SIPs started after 1 year (Retirement Age considered as 60 years)

Thus, by delaying just by one year, the investor stands to lose gaining Rs. 13,82,846 from his investment corpus.

3. Redeeming ELSS investments after the lock-in ends: ELSS investments have the lowest lock-in of three years among other tax-saving investments u/s 80C and give you the flexibility to redeem once the lock-in ends. However, use this only exit option only if you have achieved the intended financial objective. Ideally, an ELSS investment, like any other equity investment, needs a horizon of 5 years or longer. The longer one stays invested, the better the chances for risk-adjusted returns.

Suppose an investor invests Rs.10,000 per month in an ELSS investment. He will be able to redeem the first SIP investment after the lock-in period of 3 years is completed. The same process applies for subsequent installments as shown below:

| Date of investment | Total investment | NAV (Assumed) | Units Purchased | Eligible for redemption |

| 01.04.2021 | 10000 | 100 | 100.00 | 01.04.2024 |

| 02.05.2021 | 10000 | 95 | 105.26 | 02.05.2024 |

| 01.06.2021 | 10000 | 98 | 102.04 | 01.06.2024 |

| 01.07.2021 | 10000 | 102 | 98.04 | 01.07.2024 |

| 01.08.2021 | 10000 | 110 | 90.91 | 01.08.2024 |

The above illustration is only for explaining the lock-in period in ELSS SIP investments.

4. Does not complement your portfolio: You need to check the underlying investments of the ELSS mutual fund and see whether any addition you make to your portfolio is diversified and avoids duplication. At the same time, you need to assess your risk profile to see any further assessments you make balance your portfolio in terms of risk-reward dynamics. An ELSS investment is an equity mutual fund and hence is suitable for investors willing to take high to very high risk.

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.

Disclaimer: The views expressed herein in this Article / Video are for general information and reading purposes only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide/investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The Article / Video has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as of date. Readers of the Article / Video should rely on information/data arising out of their own investigations and be advised to seek independent professional advice and arrive at an informed decision before making any investments. None of the Quantum Advisors, Quantum AMC, Quantum Trustee or Quantum Mutual Fund, their Affiliates, or Representative shall be liable for any direct, indirect,