There are broadly two ways to make the recipe for a successful mutual fund portfolio. One is where you can customize as per your preference, your goal, your risk appetite, how much time you want to invest, etc. The other way is to choose a readymade diversified Fund of Funds that selects other funds to invest your money in depending on the market conditions.

DIY recipe for building your mutual fund portfolio

With the plethora of mutual fund options (over 2500+) out there, how do you weigh the pros and cons before making your choice?

Step 1: Start with a goal

This is the first step towards building a robust portfolio. Envision where you want your financial investment to take you. It may be to achieve your dream home, your child’s education, your child’s marriage or your dream retirement. Then allot a number to your goal depending on your income and expenses.

Step 2: The Right Asset Mix

As the adage goes, ‘Do not put all your eggs in one basket’, do not solely rely on one asset class to achieve your envisioned goal. Every asset class plays a pivotal role in the portfolio.

Have the right balance of all the asset classes from equity to bonds, gold, cash, that will diversify your portfolio and help to earn the total return over time to achieve your goal. The balance of risk and reward acts as a guiding principle in determining the right asset mix of an investment portfolio. For example, in March 2020, an investor who was heavily invested in equities could have had suffered losses on redemption. On the other hand, an investor, who would have not invest invested in equities after March during the rally that followed would have again missed out on growing his investment. Therefore, it becomes important to have a diversified asset mix. The presence of other asset classes such as gold could have mitigated his downside risk.

Step 3: Risk Profiling

Every single person has a different risk profile and it depends on the investors age, income, expenses, loss bearing capacity. The percentage of your portfolio you devote to each asset class depends on your risk appetite, risk capacity and risk tolerance.

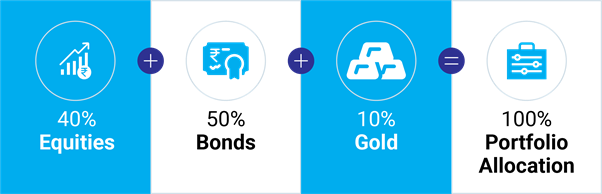

Step 4: Proportion matters

The old thumb rule of subtracting your age from 100 works fine in most cases. Subtract your age from 100 to arrive at the ideal asset allocation for your investments. So if you are 25, you need to dedicate 75% of your investment to equities whereas the rest 25% can be to bonds and gold.

On the other hand, an investor aged 60 years needs to invest 40% in equities and 60% in fixed income investments and risk reducing assets like gold.

Step 5: Filter the right mutual funds

It becomes challenging to choose which is the right mutual fund for you.

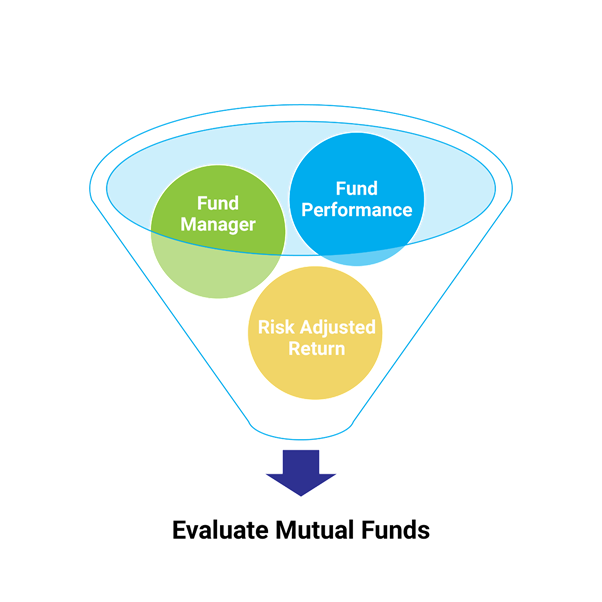

As with all investments, it’s important to research the mutual funds past results. Here are top 5 questions that you could should ask yourself while reviewing the mutual fund performance:

- How does the fund perform across timeframes? Just evaluating past one year is not enough, dig deeper to find out the fund performance across 3 year & 5 years’ time period.

- How does the fund compare across market cycles and in comparison to benchmark index and peers?

- Who manages the fund? The success of a mutual fund depends on the fund manager’s skill at choosing the right investments to enable you to get the most of the market cycles. Does the manager run other funds? If yes, then how successful have they been?

- Does it deliver risk adjusted return? A Sharpe ratio might be a good assessing point in evaluating whether the fund delivers risk adjusted returns. The Sharpe ratio measures the additional return an investor gets for the additional risk he/she takes. A higher ratio represents higher returns for every unit of risk.

Multi Asset Fund of Funds

There exist funds which invest in other mutual funds, think of this as your readymade fund portfolio that invests in various kinds of mutual funds in the market.

Such funds offer a significantly higher degree of diversification. It offers downside risk protection and the mutual fund selection then rests on the fund house that selects funds depending on relative macro and micro market trends, fund performance across timeframes and market cycles and fund manager’s competence. It offers a one-stop solution for investing in Equities, Debt & Gold. Multi Asset Fund of Funds also offers periodic re-balancing between asset classes depending on the market conditions.

In conclusion, those investors who wish to invest in multiple mutual fund schemes and do not have the time or bandwidth to research they can consider a Fund of Funds, whereas those who prefer greater hands-on approach can look at DIY asset allocation. You can also look at a combination of Multi Asset FoFs and Mutual Funds that offer diversification and help realize your goals.

Disclaimer: The views expressed here in this Article / Video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The Article / Video has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of the Article / Video should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. None of the Quantum Advisors, Quantum AMC, Quantum Trustee or Quantum Mutual Fund, their Affiliates or Representative shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary losses or damages including lost profits arising in any way on account of any action taken basis the data / information / views provided in the Article / video.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Article Shared by Quantum AMC