Article Shared by ICICI Prudential AMC

An STP or systematic transfer plan is a convenient way for investors to move the capital from one scheme to another within the same asset management company (AMC) But how exactly does STP work and why is it useful? In this blog article, we will explain the what, how and when of STP to give you a clearer understanding of this facility within mutual fund investing.

How does STP work?

STP is quite similar to SIP (systematic investment plan) in principle. With a SIP, fixed instalments get transferred from your bank account to your mutual fund scheme over regular time intervals, whereas with an STP, the money gets transferred from one scheme to another, for example, from a debt scheme to an equity scheme. As mentioned earlier both the schemes need to be within the same AMC. Furthermore, an STP requires a minimum of six transfers to be made from the source fund to the destination fund. Anything less than six transfers does not qualify for STP and therefore you will need to plan your instalments accordingly.

Types of STPs

There are three main types of STPs:

Fixed STP: In this type of systematic transfer plan, the investor chooses a fixed amount that will get transferred at regular time intervals from the source to the destination scheme. Alternatively, the investor could choose to have a fixed number of units of the source scheme redeemed at the predetermined time, and the redemption amount to be transferred to the second scheme.

Capital Appreciation STP: With capital appreciation STP, only the profits or returns earned from the source scheme within a certain time get transferred to the second scheme. This amount could vary and in some cases, a transfer might not take place if there has been no profit within that time frame.

Flexible STP: With a flexible or Flexi STP, an investor can fix a minimum amount to be transferred at each interval, but also has the option to increase the amount if required. The choice to increase the transferred amount is typically based on market conditions. This allows investors to take advantage of certain situations like a price drop in certain stocks which could prompt an increase in the STP amount in order to buy more units of the destination scheme at a lower NAV (net asset value).

When to use STP?

STP can be a particularly useful facility under two main circumstances:

Investing a lump sum amount: Typically, an investor would choose to invest a lump sum after acquiring a large sum of money. This money could be an inheritance, a bonus from work, from the sale of assets, and so on. The main concern with investing a large amount of money directly in equity schemes is that the investor might time the market wrong. To prevent this from happening, the investor could opt for an STP by first investing the amount in a low-risk debt fund, and then systematically transferring the funds to an equity fund that aligns with their investment goals, risk appetite and investment time horizon.

The advantages to using STP in this way include:

- No need to time the market as the amount is invested in small instalments over a longer duration.

- The investor gets the benefits of rupee cost averaging wherein they acquire more units of the equity scheme when the NAV is low and have an overall increase in value when the NAV goes up. Over time this averages out the cost of the units purchased.

- Investors can choose a source scheme that offers fixed returns through a modest interest rate.

Protecting returns earned on high-risk schemes: When investing in equity schemes it is important for investors to have goal-based and time-bound investments. Equity schemes tend to have higher risk levels than debt schemes and it is possible that once they have reached their investment goal, investors are still at risk of losing their returns if markets crash unexpectedly. This can be prevented by transferring the funds out of high-risk equity schemes to low-risk debt schemes as they are reaching their financial/time-based goals.

The main advantage of using STP in this way is capital protection against market risk.

Taxation on STP

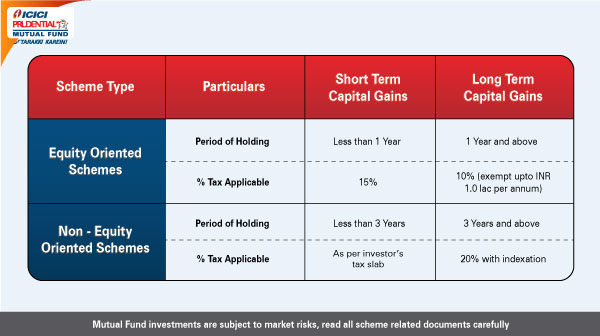

It is important for investors to be aware of the tax implications on STPs. Every transfer is considered a redemption which means that taxes will apply every time an instalment is transferred from one scheme to another. Taxes will also apply when you choose to redeem your investment in the destination scheme. Tax application is based on whether the scheme is debt or equity-oriented and the duration for which you were invested. The following table gives a breakdown of tax application:

STPs can be a useful facility when investing in or even redeeming mutual fund schemes. Understanding how they work and the tax implications could help you gain maximum benefit from this investment mode.