Article Shared By Quantum Mutual Fund

As per AMFI data, the total number of (SIP) Systematic investment plans crossed the five crore mark at 5.05 crore as of Jan 31, 2022. There are several reasons why investors are preferring a SIP mode of investment in a mutual fund. It has several advantages:

- Ensures enforced discipline: With an SIP, one invests regularly and brings discipline to their investment process, thereby negating any need for impulse investment decisions. This is useful for many investors who fall short of meeting their financial objectives because they lack the regularity required to develop a wealth corpus.

- Averages cost of investment: An SIP buys more units when the markets are falling and less when markets are rising, thereby averaging out the cost of investment. This helps mitigate the market instability to some extent. Suppose you invest Rs.10,000 per month. Here’s how you can average out the cost of investment irrespective of market levels.

- Does away the need to time the market: One does not need to time the right entry and exit point for one’s investments. Irrespective of whether the market is up or down, any time is a good opportunity to start an SIP in a mutual fund of your choice.

- Flexibility to invest in smaller amounts: Instead of investing a lumpsum amount at a time, you can invest in smaller amounts at regular intervals using an SIP.

- Suitability for any wallet size: With the minimum required investment being as low as Rs 500 per month, there is really no stopping anyone when it comes to starting an SIP. Just pick the fund(s) of your choice and start a SIP online!

- Benefit from the power of compounding:

Compounding in mutual funds refers to the returns earned on the profits from your investments. The longer you stay invested the more you benefit from SIPs due to the power of compounding.

Using a staggered investment through the SIP mode of investment, investors can diversify their investment to safeguard their investments in a volatile market. This can be achieved through a prudent asset allocation strategy.

This is something many investors ignore and end up losing money. It helps investors decide how much to allocate to each asset class.

The 12-80-20 Asset Allocation Strategy:

Here’s how investors can follow a simple strategy to ensure their money is safely allocated across asset classes.

Use the three Building Blocks of Asset Allocation:

- Emergency Block: Before one can start investing, they must set aside at least 12 months of their monthly expenses for emergencies or expenses in a savings bank account or a liquid fund scheme.

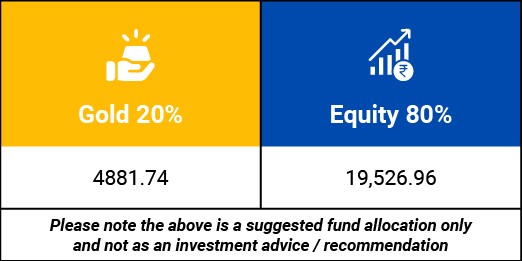

- Portfolio Diversifying Block: And the remaining 20% can go to a timeless and traditional investment option – GOLD. Because Gold has the ability to be a long term store of value.

- Growth Block: Once that is done, ensure that 80% of one’s mutual fund portfolio is invested in a diversified equity portfolio for long term risk adjusted returns.

Asset Allocation with 12-20-80 Asset Allocation

Suppose an investor has a goal of building a corpus of Rs.50,00,000 for his child’s education. And he has a duration of 10 years for investment.

This example assumes that the investor has already taken care of his emergency fund.

The investor would need to invest a SIP of Rs. 24,408.7 assuming a rate of return of 10% CAGR.

In the 20:80 ratio, the SIP would be allocated as follows to build a diversified portfolio:

Therefore, a simple and easy way to be cautious and build a healthy portfolio is to stagger one’s investment using a SIP mode of investment and revisit the portfolio allocation.

Disclaimer: The views expressed herein in this Article / Video are for general information and reading purposes only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide/investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The Article / Video has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as of date. Readers of the Article / Video should rely on information/data arising out of their own investigations and be advised to seek independent professional advice and arrive at an informed decision before making any investments. None of the Quantum Advisors, Quantum AMC, Quantum Trustee or Quantum Mutual Fund, their Affiliates, or Representative shall be liable for any direct, indirect, special, incidental, consequential, punitive, or exemplary losses or damages including lost profits arising in any way on account of any action taken basis the data/information/views provided in the Article/video.

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.