Article shared by Quantum Mutual Fund

Amid macroeconomic challenges that keep changing the investing landscape every day, what are the do’s and don’ts an investor needs to follow to maintain a robust investment portfolio for their long-term financial goals?

| Dos | Don’ts |

| Identify goals and put a number to it | Avoid heeding market noise |

| Prioritize goals as per need/investment tenure | Avoid procrastination of goals |

| Define your risk profile | Avoid taking undue risk in search of returns |

| Diversify your portfolio | Avoid concentration |

| Start a SIP to exercise discipline | Do not time the markets |

1) Identify goals and attribute a number: An investor should first decide their intended financial goal and put a number to it depending on one’s income and expenses. It may be to achieve a dream home or retirement.

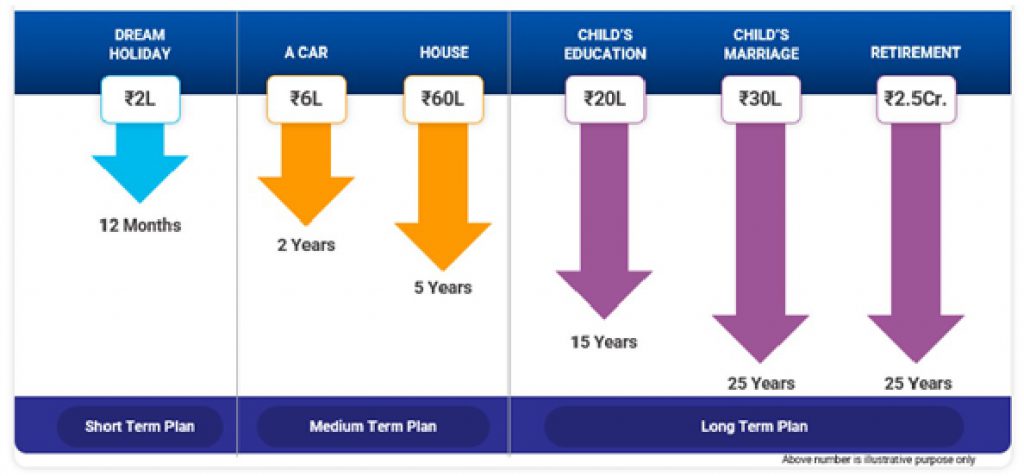

2) Prioritize goals as per need/investment tenure

Depending on the age, life stage, and time at hand, investors’ priorities change. Young investors may have a goal of buying a car or wealth building vs an individual in their late twenties or early thirties who might be prioritizing their dream house over immediate goals like a holiday. So, after an investor has laid down their priorities, they can choose mutual funds which are relevant to their goals. Investors need to assess the relevance of mutual funds to their financial goals. After this, investors need to stay invested until their goal is achieved.

3) Define risk profile

When investors begin their mutual fund journey, they may find that a solution that has worked for one may not work or be suitable for another investor. This is because one’s choice is based on his/her risk profile. Investors have to be well-acquainted with their goals and the timeframe to assess the level of risk they are comfortable with taking on. Generally, equity funds are more volatile than fixed-income funds and may be suitable for a long-term investment horizon, and those with an aggressive risk profile. Investors who have a conservative approach may look for safety over returns and may opt for fixed deposits or other fixed income instruments with minimal risk. Investors who prefer a balanced risk-reward ratio might prefer a multi-asset fund of funds with a diversified portfolio comprising equity, debt, and gold.

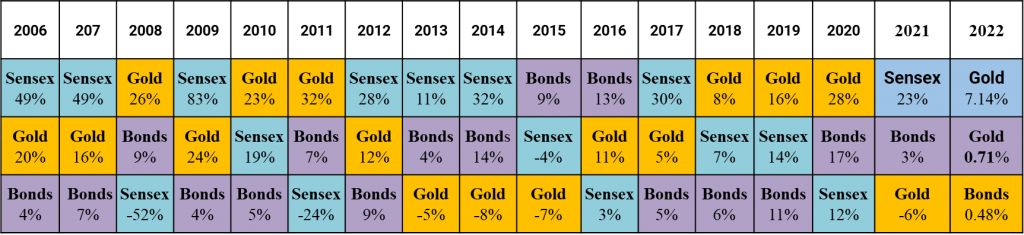

4) Diversify portfolio: Uncertainty is the only certainty in financial markets. As we have witnessed in the event of previous black swan events in history such as the Covid Crisis in 2020 or the Global Financial Crisis of 2008, there is no one winning asset class or investing style that can sustain for long. As the adage goes, ‘Do not put all your eggs in one basket. So do not solely rely on one asset class to achieve one’s envisioned goal. Every asset class plays a pivotal role in the portfolio. Remember there have been years when equity markets had a brilliant run, years when only bonds were dependable, and years when gold shined the brightest, and these periods did not typically overlap. Thus, it is important that investors need to diversify their portfolios across equity, debt, and gold. Diversification of investment lowers portfolio downsides without reducing the expected returns.

Past performance may or may not be sustained in future

* YTD – Jan to Mar2022

The chart ranks the best to worst performing indexes per calendar year from top to bottom

Indices Used: S&P BSE Sensex; MCX Gold Commodity Index and

CRISIL Composite Bond Fund Index

Source: Bloomberg

5) Ignore the market noise and resort to a prudent asset allocation strategy: While no one has a crystal ball to predict the near-term market levels and the impact on your investments, it’s usually best to ignore the market noise about the right time to invest or redeem- and stick to a long-term plan using a prudent asset allocation strategy. based on a 12-20-80 asset allocation strategy. For instance, during the pandemic-induced market crash in March 2020, an investor who was heavily invested in equities could have suffered portfolio drawdowns. On the other hand, an investor, who would have not invested in equities after March during the rally that followed would have again missed out on the potential to grow his investment. Therefore, it becomes important to have a diversified asset mix. The presence of other asset classes such as gold could have mitigated his downside risk. The imperfect correlation between asset classes & regular rebalancing of the portfolio will ensure investment balance and minimize the impact of losses driven by falling markets.

Here are the building blocks that form this strategy:

- Foundation Block:

As a preliminary step, set aside an emergency fund which should be at the foundation of your portfolio. Set aside safe equivalent to 12 months of current expenditure in savings bank accounts and liquid fund schemes.

- Portfolio Diversifying Block:

Of the remaining money, 20% should be invested in Gold ETF or Gold Mutual Funds. Gold generally tends to perform better when equities are under stress thus helping you overcome the fear of losses.

- Growth Block:

Diversify the balance 80% across an equity basket comprising a Value Fund, ESG Fund, and Equity Fund of Funds.

70% in Equity Fund of Funds: There exist equity funds that invest in other equity mutual funds, think of this as your readymade fund portfolio that invests in various kinds of equity mutual funds in the market.

Such funds offer a significantly higher degree of diversification. It offers downside risk protection and the equity mutual fund selection then rests on the fund house that selects funds depending on relative macro and micro market trends, fund performance across timeframes and market cycles, and fund house investment processes and trends.

15% in ESG Fund: ESG investing incorporates the three non-financial parameters of the environment, social, and governance that have a material impact on the future of earnings potential and valuation, making them important considerations for investors.

15% in Value Fund: When valuations appear elevated and there is uncertainty in the market, investors can reduce downside risk with a value fund. A value fund portfolio is at a discount to its intrinsic value based on the historical average.

Investment portfolio with 12 – 20 – 80 strategy

| Asset Class/Building Block | Proportion of Allocation | Diversification | Suggested Schemes |

| Emergency Block/ Fixed Income | Equivalent to 12 months of expenses | Liquid Fund Schene | |

| Portfolio Diversifying Block/Gold | 20% | Gold Fund ETF or Gold Mutual fund (if you do not have a Demat account | |

| Growth Block/ Equity | 80% | 70% of equity allocation | Equity Fund of Funds |

| 15% of equity allocation | Value Fund | ||

| 15% of equity allocation | ESG Fund |

Please note the above is a suggested fund allocation only and not as an investment advice/recommendation.

- Stagger investments with a SIP: Investors have two modes to invest – Lumpsum and SIP. So, as the term implies, an SIP (Systematic Investment Plan) lets investors allocate a fixed sum of funds in a periodic manner in a preferred mutual fund scheme. Once an investor starts a SIP in a fund and gives a standing instruction to the bank, the specified amount gets deducted from their savings bank account on a periodical basis be it monthly, weekly, or daily. This will negate any worry for timing the market. Time spent in the market will help investors benefit from the compounding of returns in the long run. Compounding is where one’s returns get reinvested and add to their investible corpus.

- Periodically Review & Rebalance: Finally, investors should consult his advisor to re-evaluate their strategy from time to time. Rebalancing is required to bring assets to their original allocation and investors must remain rational when making decisions to change one’s plan of action as needed.

In conclusion, by using the building blocks with underlying assets in Equity, Debt and Gold, investors can negate any worry concerning market uncertainty and achieve their long-term financial goals.

Disclaimer: The views expressed here in this Article / Video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide/investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The Article / Video has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and the views given are fair and reasonable as of date. Readers of the Article / Video should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. None of the Quantum Advisors, Quantum AMC, Quantum Trustee or Quantum Mutual Fund, their Affiliates, or Representative shall be liable for any direct, indirect, special, incidental, consequential, punitive, or exemplary losses or damages including lost profits arising in any way on account of any action taken basis the data/information/views provided in the Article/video.

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.