In the last few days, so many of our clients have enquired about few Insurance plans from HDFC and ICICI, that we have been pushed to clarify our stance on it.

At the outset, we confess – that the world of Insurance is utterly opaque and confounding. No one fully comprehends it (including us):

- There are too many inbuilt charges like premium allocation charges, management fees, admin charges, mortality charges, etc.

- Most of these charges are levied via the deduction of units and not adjusted in the NAV. Hence, the performance of the scheme never reflects badly. But individual holders never make a return.

- Most importantly, the bulk of the holders have not lived long enough thus far, to experience if the real committed value is being delivered in such plans.

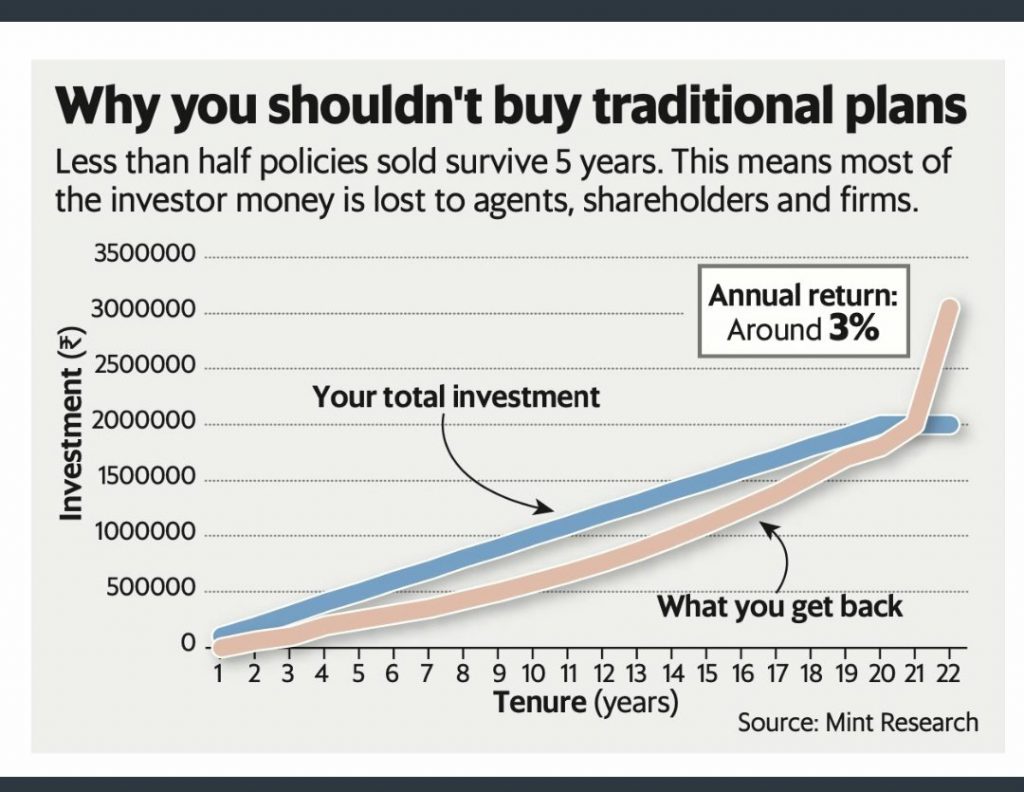

- And last, less than half the policies sold don’t even survive for 5 years – only resulting in losses for investors. Most of these are surrendered. Do have a look at the attached persistence chart for reference.

There is a lot of buzz in the market around few Insurance products like HDFC Sanchay Plus, ICICI Pru Gift Long Term, etc.

There is a high probability that your banker or local distributor has already done a hard sell of these plans to you till date. And perhaps sighting tax advantages available only till 31st March – that push would have become extremely unbearable by now. New Budget has sounded the death bell for these plans (if the total premium amount is greater than 5Lacs for the full FY wef 1st April 2023) and hence, the high-decibel noise all around.

Here’s our dispassionate view on such plans:

- The approximate IRR for different plans offered under these products is roughly 5.5% – 6.8%.

- Possible that your banker has shown you slightly higher IRRs – we take it with a pinch of salt and request you to go through the two articles appended at the end of this mail.

- We are not going into the details of computing IRR ourselves – for multiple reasons of trust stated at the start of this mail. Also, the calculations can drastically vary as per the age of the policyholder, premium paying term, etc. We will rely on a few published calculations for the same given at the end of this mail.

- If you take into account GST to be paid on every premium, the above IRR will further get diluted by about 20 – 50bps.

- With an ROI of 6% and a tenor of 20-40 years – this product does nothing but simply play on the long-term compounding card and guaranteed additions at the end of full policy terms.

- These products barely beat inflation over the long term and don’t allow you the flexibility of easy withdrawals.

- Surrender or early withdrawal will kill most of the returns – and more often than not will even lead you to losses in such products. As the bulk of the benefits are back-ended.

- Most of these products are pushed in the names of younger family members to save on mortality charges – which also defeats the purpose of Life Cover per se.

- And if you buy it after say age 40 or so, mortality charges will be extremely high and your IRRs will further dilute big time.

- Bankers are being offered crazy commission rates to push this product right now (which itself is a big red flag for us).

- To know the commission rates – see the tweet below at the end of this article.

While we don’t claim to be experts on the subject of Insurance. But we can for sure tell you that an Edelweiss Bharat Bond 2033 paper is quoting at an approx. the yield of 7.51% and offers you 11 indexations if invested in this FY. Assuming, a 6% inflation – your net yield could be anywhere from 7.0 – 7.2% post-tax, and post-indexation. The product has the lowest expense ratio of 6bps (0.06%) and the highest paper quality. Plus, it gives you the flexibility to exit at any time without any exit charges. And there are many such high-quality, low-expense, fully-transparent products available in the market.

Do read through these interesting articles which show the actual IRRs and the below tweet which tells you the commission rates involved, before you succumb to the unrealistic pressure of your Banker 😊