Article written by Quantum Mutual fund

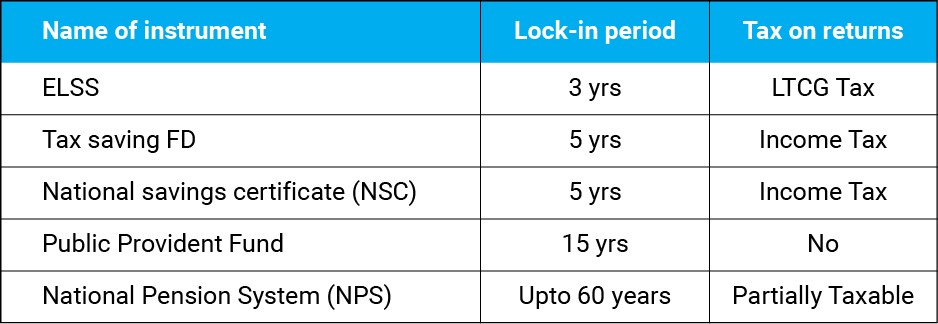

Through the years, you’ve been saving taxes with Public Provident Funds (PPFs), National Savings Certificates (NSCs) and Bank Fixed Deposits (FDs). Sure, these are good and “safe” options but have you ever considered another option which has the potential of generating returns linked with market earnings along with saving taxes?

Equity Linked Savings Scheme (ELSS) is one such option. Tax-saving mutual funds, also known as ELSS offers twin benefits of tax savings and opportunity to build wealth by investing in equities for the long term. It comes with a lock-in period of three years.

ELSS = Tax Benefits + Potential Long Term Capital Appreciation

ELSS mutual fund is well suited for long term goals such as children education & retirement planning. The portfolio of these funds is dominated by equity-linked instruments such as shares. Equity Linked Saving Scheme (ELSS) is a type of mutual fund that is eligible for tax deduction benefits under the section of 80C of the Income Tax Act, 1961. Due to market linked returns and lowest lock-in period in the tax-saving category, ELSS has become more popular in recent times. You can invest in ELSS either in lumpsum or through Systematic Investment Plans (SIP). Though ELSS funds are subject to market risks, historical data shows that equity has been best performing asset class over long investment horizon.

Features of ELSS

1. Tax Benefits u/s 80C: Investments upto Rs.1.5 lakh a year in ELSS are eligible for tax deduction benefits under section 80C of the Income Tax Act, 1961.

Investments in Equity Linked Savings Schemes or ELSS mutual funds qualify for deduction from your taxable income under Section 80C of the Income Tax Act 1961. The maximum investment amount eligible for tax deduction under Section 80C, is Rs 1.5 lakhs.

Since it is subject to the growth of the equity markets, ELSS returns are taxable at 10% if the gain exceeds Rs. 1 lakh in the year.

Earlier ELSS was also tax-exempt after 1 year, but with budget 2017-2018, now any gains in equity mutual funds or stocks are taxable @10% when you sell them, but you get an exemption of Rs 1 lac per year. This means that if your profit after selling ELSS is Rs. 4 lacs, then you have to pay a 10% tax on 3 lacs.

2. Lowest Lock-in: ELSS investment comes with a lock-in of only 3 years which is lowest in the tax-saving category, making ELSS investments a relatively more liquid option. You can actually redeem your ELSS fund investment in just 3 years.

3. Liquidity: ELSS mutual funds are also liquid investments u/s 80C. You can redeem your ELSS units partially or fully after the lock in period of three years is complete. However, it needs to be mentioned here that, you do not necessarily have to redeem your ELSS units after the expiry of the lock-in period. You should redeem according to your financial needs and invest in ELSS as per your financial goals.

4. Opportunity to invest in equities: ELSS mutual funds invests 80% in equity and equity related instruments, Historical data shows that equities have potential to earn relatively high returns vis-à-vis high risk as compared to other asset classes such as fixed income and gold etc. over a long period of time.

5. Option to invest by SIP: The systematic investment plan (SIP) option is probably the best feature while investing in ELSS since you can invest a small amount (as low as Rs. 500) every month for a specific period.

How does SIP in ELSS scheme work

When you are making a lumpsum investment, it is easy to understand how the lock-in period works. Suppose the amount invested is Rs. 1 lakh you can withdraw the entire amount once the investment completes three years. If you are investing via an SIP, the three-year lock-in period is applicable to every SIP instalment. That means, only the first SIP instalment will complete three-year lock-in period at the end of three years.

Every SIP installment is treated as a separate investment and it will be locked for 3 years. For example, your SIP investment on 02 Feb 2021 will be locked till 01 Feb 2024 and your next SIP investment on 02 Mar 2021 will be unlocked on 01 Mar 2024 and so on.

Remember, it is not mandatory to redeem your units after the lock-in period ends. It is recommended to invest in equity for the long-term (7-10 years), the lock-in should not make a difference to the way you treat your investment.

What are the parameters used to evaluate ELSS

To understand if an ELSS is performing well, you need to look at its parameters such as:

- Past returns: You may start with analyzing the fund’s performance over the last five years. Look how well the fund performed across market cycles.

- Expense ratio: The returns generated by the fund must be backed its expense ratio. A higher expense ratio indicates that there are frequent changes in the fund’s constitution, which is not a good indication.

- Financial ratios: A top-performing fund is not impacted much by the market turbulence. Apart from these, you have to look at ratios such as Alpha, Beta and Sharpe ratio.

Investors need to note that it is important to pick a scheme based on return expectations, risk appetite and investment time horizon. ELSS funds are more suitable for those individuals who are open to the risk appetite and stay invested for a longer time period so as to reap its benefits.

Disclaimer: The views expressed here in this Article / Video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The Article / Video has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of the Article / Video should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. None of the Quantum Advisors, Quantum AMC, Quantum Trustee or Quantum Mutual Fund, their Affiliates or Representative shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary losses or damages including lost profits arising in any way on account of any action taken basis the data / information / views provided in the Article / video.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.